Thursday, November 29, 2007

Ford--Microsoft Sync: Videos

--

--

--

--

--

I wonder if anyone has used this as a business case example to understand the opportunities and challenges of competing in a network era.

Ads in Adobe PDF Documents Inserted by Yahoo

By now, everyone (well, nearly everyone!) is all familiar with what Google has done to online contextual advertising--search, maps, GMail, etc. As we do more things online, it is just a matter of time that every interactions on the web will be facing potential onslaught of contextual advertising. So, here's the latest: Advertisements contextually inserted into PDF documents created on the Adobe website. According to an article in The Advertising Age:

The service with a mouthful of a name -- it's called "Ads for Adobe PDF Powered by Yahoo" -- targets the growing stable of publishers focused on online formats, many of whom are moving to web-only models. Under the program, which is in test mode, publishers can insert contextual text-based ads within Adobe's Adobe Reader and Adobe Acrobat brands.The benefits are obvious. Again as summarized in the article...

For publishers, the program may be an additional source of revenue, potentially offering readers more free content. Advertisers, meanwhile, can tap into a new type of content and will have the ability to track advertising performance the same way they do with web-placed ads.According to Adobe's press release, the process works as follows:

To join the program, publishers must register online, and then simply upload their Adobe PDF content so that it can be ad-enabled before distributing PDFs as they do today. Ads can only be displayed within Adobe Reader and Adobe Acrobat, in a panel adjacent to the content so that they do not disrupt the viewing experience. Every time the PDF content is viewed, contextual ads are dynamically matched to the content of the document. The publisher can then monitor performance through detailed reports. Publishers already committed to participating in the Ads for Adobe PDF Powered by Yahoo! beta program include: IDG InfoWorld, Wired, Pearson’s Education, Meredith Corporation, Reed Elsevier and many more.

“Since moving to a Web-only format earlier this year, we at InfoWorld have been able to apply a laser focus to cutting-edge solutions for the electronic distribution of our content,” said Allen Fear, director of Online Content at InfoWorld. “The unique combination of Adobe PDF and Yahoo! ads presents a new way of generating revenue from many of our existing products. We are excited about the opportunity to work with Adobe and Yahoo! on what we believe is a solution that significantly enhances the value of PDF distribution.”

--I find this interesting as it is another example of business ecosystem in formation with Google and Yahoo offering alternative advertising platforms. In the case of Yahoo, this particular initiative is an attempt at expanding its advertising platform scope by joining together with a document platform architect, Adobe. Will this initiative attract massive network effects? The marketplace will judge whether this offering is compelling enough to compete effectively against Google. Welcome to the content network!

Tuesday, November 27, 2007

Media 2.0: Two Network Connections to Track

--

Two announcements about corporate connections caught my attention and I think these are potentially very significant.

October 24, 2007: Google announced a relationship with The Nielsen Company.

...the companies have established a multi-year, strategic relationship. As a first step, the relationship leverages Nielsen’s experience in television audience measurement to bring demographic data to the Google TV Ads™ advertising platform. By combining Nielsen demographic data with aggregated set-top box data, Google can provide advertisers and agencies with comprehensive information to help them create better ads for viewers and maximize the return on their advertising spending.

Google TV Ads is an online platform for buying, selling, measuring and delivering television ads. The platform, which has been operational since May, includes advertising inventory across hundreds of channels and all dayparts. A key benefit of Google TV Ads is the ability to report second-by-second set-top box data so advertisers can evaluate the reach of an ad and only pay for actual set-top box impressions. Advertisers can better understand exactly how their ad is performing and make near real time changes to their TV advertising campaigns to deliver better ads to viewers. Data derived from Nielsen’s representative television ratings panels will provide Google TV Ads advertisers with the demographic composition of the audience.

This is the first time that advertisers and agencies will have this level of detailed measurement available in a single place and at such a large scale. This information is available through the existing Google AdWords™ report center

Moving forward, Google and Nielsen will explore a number of other opportunities to work together to measure online and other media.

--

November 27, 2007: NBC and TiVo announced a relationship. WSJ reported that:

The agreement, announced today, reflects rising demand in the TV industry for detailed audience viewing information. TiVo, a provider of digital video recorders, about a year ago started offering advertisers second-by-second ratings of programs and commercials based on the viewing habits of its subscribers, as well as other services. Earlier this month, the Alviso, Calif., company added demographic data about the viewers themselves, such as age, income, marital status and ethnicity.

NBC Universal's agreement with TiVo will give the TV concern's networks, such as NBC, Telemundo and Bravo, as well as its NBC owned-and-operated TV stations, access to TiVo's ratings data.

The deal comes as advertisers, media buyers and TV executives continue to grapple with a changing TV ad landscape, where an increasing number of viewers are using digital video recording devices to fast-forward through ads.

With its research, TiVo is competing with industry giant Nielsen Media Research, which also offers commercial-ratings and demographic data. Advertisers, media buyers and TV networks have made many of their ad deals this year based on Nielsen ratings of TV commercials.

--

So, what are we seeing here?

The set-top box is a critical point of control--whether it is TiVo box or one provided by the cable/satellite operator--for advertisers. Both the relationships (Google-Nielsen and NBC-TiVo) are jockeying to extract valuable data from the set top box. Nielsen has the potential to integrate a broader array of information but Tivo is more widely deployed. It will be interesting to see what other relationships are formed with other entities in the media space (for example: what role if any for Motorola and Cisco/Scientific Atlanta that make the set top boxes--are they simply hardware providers or can they expand to play critical roles here?). There are also huge privacy issues and challenges that both TiVo and Google have dealt with before.

--

These are not just two random announcements of corporate connections. They reflect the shifts underway and by no means will they be the last ones we see in this space.

Google's GDrive as a Holiday Treat?

--

WSJ reported today (Nov 27) that:

Google is preparing a service that would let users store on its computers essentially all of the files they might keep on their personal-computer hard drives -- such as word-processing documents, digital music, video clips and images, say people familiar with the matter. The service could let users access their files via the Internet from different computers and mobile devices when they sign on with a password, and share them online with friends. It could be released as early as a few months from now, one of the people said.--

Why is this interesting and relevant? Simply because it is another piece of the puzzle about the shift to a network era. Sure, there are others that provide such a service (some free, some for a fee). But, Google's move is interesting and potentially important since we use its services (and applications) so often and on such a regular basis. Sure, GMail now gives me 5GB data storage and I can get huge data for my photos on Picasa (by paying a fee) but these are stored in silos (which is so yesterday!).

--

I think this will be a welcome gift for the holiday season!

Friday, November 23, 2007

Sync--TV Commercials

--

It will be interesting to watch how well the consumers embrace Sync and whether this will allow Ford to gain a higher market share than otherwise. Is this a killer-app? Will this be more of a competitive advantage for Ford than what OnStar has been for GM?

Sunday, November 18, 2007

Imagine this Number--$12.3 Billion for Digital Maps!

--

These acquisitions are happening at the periphery of the telematics market where GM continues to push OnStar and Ford and Microsoft are working together on Sync. Clearly telematics is simply one setting to extract value from digital maps. The maps will come handy as more mobile phones deploy applications that are location-based and Google brings its advertising expertise into the mobile arena through its software platform.

--

The network boundaries are blurring. This space is worth watching as we better understand how companies better leverage location of customers as a critical anchor for product-service strategies.

Friday, November 9, 2007

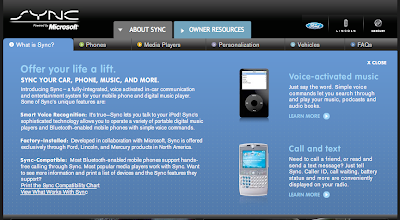

Ford--Microsoft Sync

--

The discussions invariably turn to competitive reactions and responses. Ford created a joint venture with Qualcomm a few years back called Wingcast but that did not last too long. Recently, Ford and Microsoft have joined together to create Sync.

Sync is available on a wide range of Ford model automobiles in 2008.

--

Here's a good review of Sync by Walt Mossberg of Wall Street Journal.

--

I am looking forward to the next opportunity to discuss telematics as an example of the network era with interesting developments from auto companies such as GM and Ford. In addition, there is a lot of excitement in the telematics space with Nokia acquiring Navteq for over $8 billion. Garmin and Tom Tom are bidding in the $3 billion-plus range for TeleAtlas. The business networks are evolving and morphing in important ways--which make this a challenging arena to examining the nuances of competing and succeeding in a network era.

Tuesday, November 6, 2007

Gphone Announcement: 'Google Inside Mobile Phones'

--

How successful will it be? That's a multi-billion dollar question (stock market valuations are based on Google's ability to be a dominant force in the mobile handsets). This strategy requires Google to become a leader in orchestrating an ecosystem and that is a new area for Google. This is an area that Microsoft has more experience and has historically done well. What Google is trying to do is to become 'Google Inside' the mobile phones of tomorrow. It is a strategic move that is brilliant but requires flawless execution. Intel succeeded with this strategy with a broad set of personal computer makers that were creating Wintel (Windows-Intel) computers and laptops. Can Google succeed with 'Google Inside' mobile phones? Worth watching since it marks a shift in its strategy that calls for new capabilities for orchestrating a portfolio of relationships.